Every NFL offseason, it seems like the market, at least in one position, changes in a significant way. Guards got paid in a massive way this offseason, and wide receivers are beginning to as well. Meanwhile, the safety market seemingly collapsed while the running back market had a rally.

But that's just one offseason, and it's significantly affected by the timing of which players happened to hit free agency. To get a complete picture of how positional markets have shifted, it's better to look at a larger sample. And because teams can manipulate cap numbers in a variety of ways by using things like restructures, void years and option bonuses, it's also better to look at cash spending than cap spending.

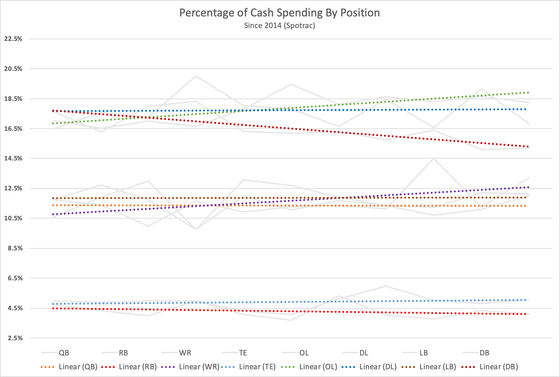

The chart below shows the percentage of cash spending at each position for every year since 2014, as well as the trend line for those positions. Those trend lines are labeled "Linear (Position)" in the chart. Basically, the chart shows how NFL teams have allocated their spending over the last decade, as well as in the season to come.

There are a few very easily noticeable trends here.

First, you can see that the offensive line, defensive line and defensive back groups are taking up the greatest shares of the cap. The reason for this should be obvious; teams are playing between four-to-six players -- or even seven -- on any given snap, and thus have more of them on their roster than they do players at any other position.

The next group consists of quarterbacks, wide receivers and linebackers. Again, the reason is obvious. There is only one quarterback on the field, but the best quarterbacks make significantly more money than anyone else, which bumps the position into the same bucket as receivers and linebackers, where teams typically have between two and four of them on the field at any given time.

And lastly, the running backs and tight ends check in at the bottom. There are usually just one or two of those players on the field, and the depth charts are shorter than they are at most other positions. In addition, running back contracts had been on the decline until this past offseason, while the spread of elite pass-catching tight ends is a more recent phenomenon.

Then we come to the trends. The single-most noticeable one is that offensive linemen are trending way up, while defensive backs are trending way down. There are likely multiple reasons for this. First, right tackles have, in recent seasons, been catching up to left tackles when it comes to contract size. Second, teams are increasingly willing to pay big money for guards. And third, with teams using more defensive backs at a time, it has put some downward pressure on the market at which is generally considered a "weak-link" unit. (Meaning, even if you have the NFL's best cornerback, if one of your other defensive backs is really bad, opponents will just pick on him instead.) Particularly at safety, this has resulted in a significant shift away from big, long-term contracts. The market for corners hasn't quite gone that way just yet, but it hasn't been increasing by as much as other positional markets.

After that, you can see that the trend line for wide receivers is unsurprisingly slowly creeping up, while tight end spending has seemingly increased at the same rate that running back spending has decreased. Spending at quarterback and linebacker, interestingly, has been relatively flat -- at least in terms of the share of league-wide cash. That's likely because even as the best quarterbacks have seen their salaries explode, the fact that there are relatively few of them and that teams without one tend to keep cycling through much lower-paid players on rookie-scale deals, and that backup quarterbacks make a relative pittance compared with starters, keeps the overall share of money somewhat in check.

The operative question, of course, is whether these trends will continue, and if they don't how things will change. As quarterbacks keep making more and more money, there is going to be a smaller share of the pie available for everyone else. Will teams continue to prioritize both the offensive line and wide receivers, or will one or the other take a step backward? Can the running back market really trend any further down? And with more defensive backs on the field than ever, can corners and safeties reverse their trend? These are all significant issues to watch as the league moves further into the 2020s and beyond.

![[object Object] Logo](https://sportshub.cbsistatic.com/i/2020/04/22/e9ceb731-8b3f-4c60-98fe-090ab66a2997/screen-shot-2020-04-22-at-11-04-56-am.png)